IT budgets are declining on average, and while planned storage spending is dipping, too, it accounts for 13.5% of the overall IT budget. That figure, based on survey data collected by 451 Research’s TheInfoPro service for the first half of 2014, actually shows storage’s share of the budget grew from 9.5% during the same period last year.

And while the overall spending average shows a decline, a larger number of companies are planning to increase storage spending to some degree than those cutting back, according to a presentation delivered by TheInfoPro research analyst Nikolay Yamakawa during the recent Flash Memory Summit. (For more information on the survey, please read this 451 Research/TheInfoPro blog post.)

Survey taps mid-sized, enterprise companies

TheInfoPro surveyed 265 Global 2000 companies with revenues of at least $1 billion; survey respondents were split roughly down the middle between IT executives and managers and architecture and engineering specialists. When ask to rank their top storage projects for 2014, 8% of the respondents cited flash implementation—the first time solid-state-related activities appeared in the top five of the project list.

Source 451 Research, LLC. www.451research.com

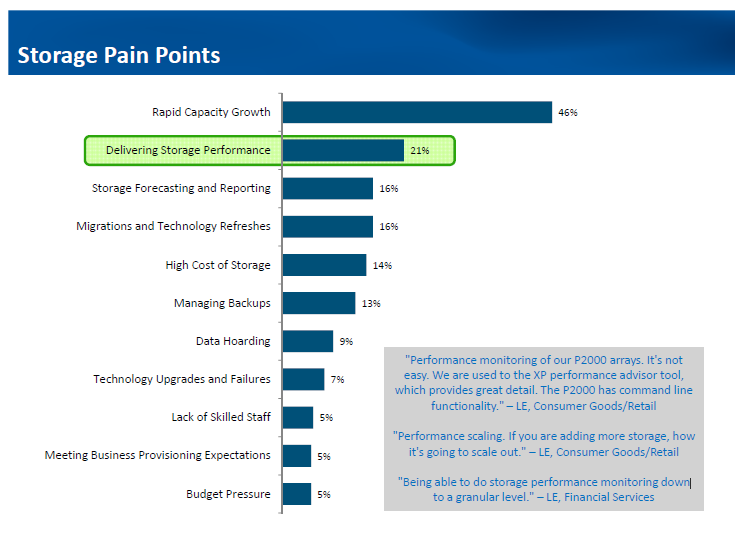

Some of that flash storage is likely to be deployed to ease one of the key storage-related pain points noted by 21% of the survey respondents: “delivering storage performance.” Performance was the second biggest pain point, trailing only “rapid capacity growth.”

Databases loom as leading flash apps

For current flash users and those planning implementations, database applications loom as the likeliest candidates to get a boost from solid-state storage, as noted by 38% of respondents. Next in line for a flash jump start are virtual desktop infrastructure projects (19%) and analytics apps (16%).

Among the most desired features for flash storage implementations, Quality of Service (QoS) controls ranked highest with 74% saying it was very or extremely important. Tools to manage flash data’s lifecycle (72%) were next, followed by cache coherency management (56%).

But make no mistake, when it comes to flash storage the name of the game is speed. When asked if they had specific IOPS requirements, 73% said yes—a big jump from the 52% who said they were looking for a performance boost last year. Delving deeper into the need for speed, 47% said they looking to deliver more IOPS to their apps and 21% need to address latency issues.

Still limited use of caching apps

For only 40% of server-side solid-state deployments some type of caching software is being used, but the rest of the flash devices are begin used for persistent storage. Still, a lot of flash is being used as cache or as part of active automated tiering schemes, as 48% of current flash users say the continuously move data on/off solid-state storage. Fifty-nine percent of respondents who said they were using auto-tiering rated it a “success” with 32% indicating that they’re experiencing some stress in their tiering setups.

Where flash works best

The key question for many companies is not whether or not flash should be a part of their storage environments, but rather where to put that flash. TheInfoPro survey indicated that 67% of current users have solid-state installed in their SAN or NAS arrays (hybrid flash array), 25% have it slotted in servers and 8% are using all-flash arrays (AFAs). For future implementations, 12% are considering hybrids, 13% are looking server-side and a whopping 22% are aiming at AFAs.

For AFAs, EMC, Violin Memory and Pure Storage are the leaders among those already using these arrays, with EMC and Pure Storage appearing most often as choices for prospective implementations. EMC leads again in the already-implemented hybrid category, with NetApp, Hitachi, IBM, HP and Dell following. Not surprisingly, server-side flash pioneer Fusion-io still dominates that market segment.

Looking at some of the newcomers in the flash storage sphere, Nimble Storage, Pure Storage and Nimbus Data have gained the greatest awareness among users to date.

For more survey-based data and analysis on flash storage, read the analysis of the latest TechTarget Storage Purchasing Intentions Survey and our Snapshot Survey report, Use of solid-state technology continues to climb. And for information on a wide variety of solid-state storage product and implementation topics, please visit SearchSolidStateStorage.com.

The post Survey says budgets dipping but interest in flash storage rising appeared first on Storage Soup.